M2 Second semester, courses

Econophysics

In this set of lectures, I will mostly describe a statistical physics approach to financial markets.

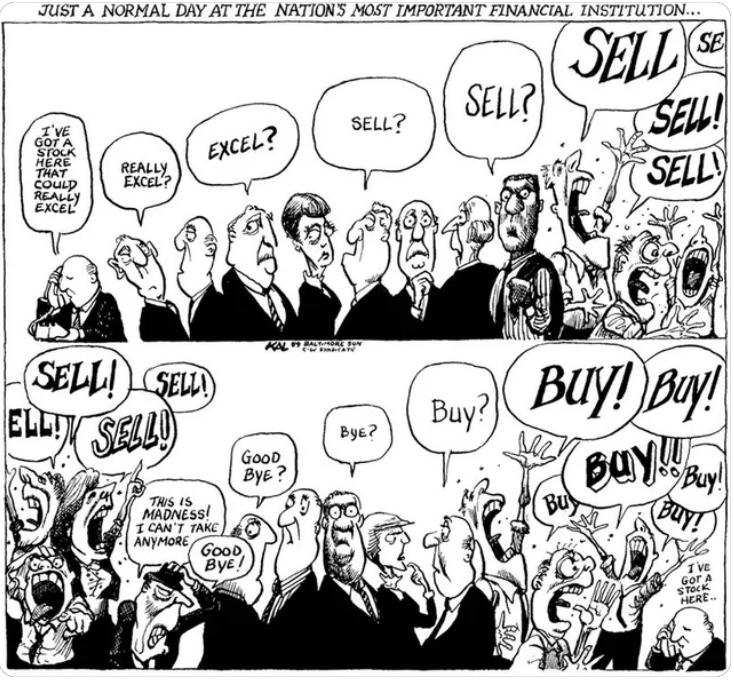

Ever since Bachelier’s PhD thesis in 1900, which introduced a theory of Brownian motion applied to financial markets, statistical physics has been a fundamental tool to understand and model their behavior. This analogy is natural: the price formation mechanism results from the actions of thousands of individual agents, much like how the microscopic dynamics of atoms, molecules, or spins give rise to the macroscopic properties of liquids, gases, or magnetic systems.

Another important reason is that modern financial markets generate an enormous amount of data, allowing scientific theories to be tested with a level of precision comparable to that achieved in the physical sciences. This represents a truly fascinating challenge.

This course presents some of the recent approaches physicists have developed to analyze and model financial markets, always keeping close contact with real data.

Syllabus:

- Introduction to probability theory ; with emphasis on power-law distributions, the behavior of sums of random variables (central limit theorem and its generalizations), and the statistics of extreme events.

- Empirical financial time series ; general properties and stylized facts, with a focus on time correlations, distributions of price changes, and realistic modeling.

- Mechanisms of price formation ; why and how prices change. We will introduce the limit order book, which underlies real-time price updates in modern markets, and discuss econometric and agent-based models that aim to reproduce the general features of price dynamics through trader interactions.

- Financial engineering and portfolio optimization ; a theoretical framework to design products suited to investors with different risk profiles. We will present the Black–Scholes model as well as more modern approaches beyond it.

- Correlations across assets ; analysis of covariance matrices built from stock time series, to identify and possibly exploit correlations hidden in the background noise. This chapter makes direct use of random matrix theory.

Marco Tarzia

(LPTMC, Sorbonne Université)

Comments are closed